UPI Logo | Photo Credit: Internet

Clear Cut Livelihood Desk

New Delhi, UPDATED: Oct 17, 2025 12:58 IST

Written By: Janmojaya Barik

A Trillion Transactions and Growing

Within a decade, India’s Unified Payments Interface (UPI) has transformed from a government-supported pilot project to the lifeblood of a digital economy. Developed by the National Payments Corporation of India (NPCI) in 2016, UPI was aimed at getting money transferred easily from one bank account to another. Today, by 2025, UPI has become the biggest real-time payment platform in the world.

According to the RBI’s March 2025 Bulletin, UPI processed 185.8 billion transactions in FY2024–25 — up 41.7% from the previous year. In value terms, this translates to ₹261 lakh crore, a year-on-year growth of 29.3%. It now accounts for 83.4% of India’s total digital payment volume.

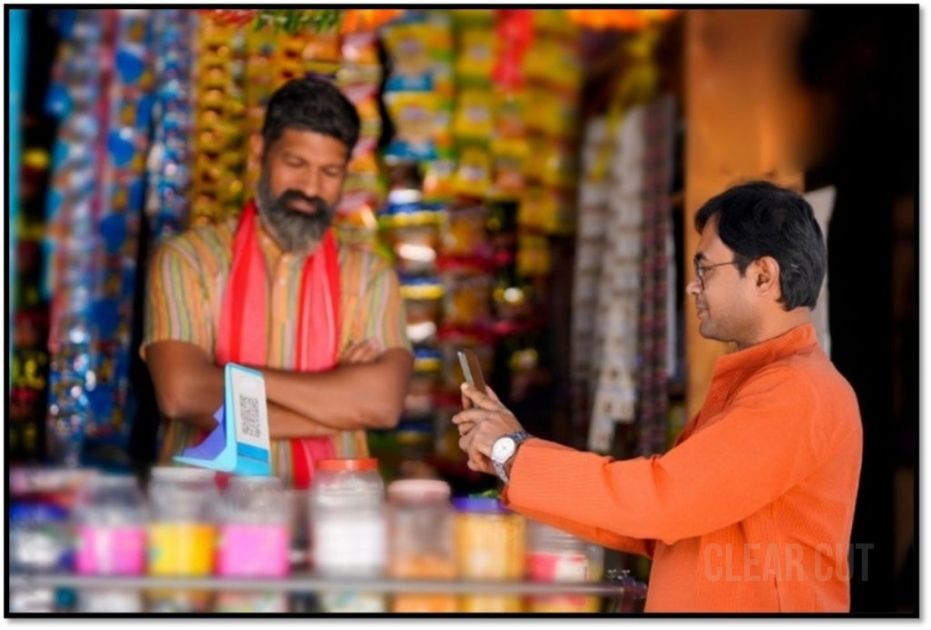

This momentum indicates how deeply digital payments have penetrated Indian daily life. From vegetable vendors to major retailers, UPI QR codes are now a part of the social and commercial life of the country.

Rural India Leads the Digital Way

The actual story of UPI growth is outside the cities. A PayNearby–IBEF survey in 2024–25 indicated that digital payments in semi-urban and rural outlets grew 118% in volume and 106% in value over a financial year. In small towns and villages, UPI is now the most accessible gateway to formal finance.

The CII–EY Digital Payments Index 2025 revealed that 38% of semi-urban and rural consumers now prefer UPI to cash, while 96% showed faith in using digital channels for micro-investments and savings. Rural India is no longer a passive recipient of digital inclusion that it is powering the next fintech growth wave.

This development is in line with the DPI strategy of the government, where UPI is integrated with Aadhaar and Jan Dhan accounts. Up to January 2025, more than 515 million Jan Dhan accounts had been linked with mobile numbers, making easy onboarding of UPI users possible.

UPI and the Global Stage

UPI success is now beyond Indian shores. With collaborations with Singapore’s PayNow, France’s Lyra, and UAE’s Mashreq NeoPay, UPI has become a standard to emulate in interoperable, inexpensive payment systems globally. Cross-border UPI payments in FY2025 expanded 67% reflecting its prospects as an international benchmark for emerging economies.

India generated 48.6% of all real-time payments across the globe, a far distance away from China (12.8%) and Brazil (6.7%), based on the ACI Worldwide Real-Time Payments Report (2025). This leadership is testimony to both the enormity and efficiency of India’s digital payments system.

Revolutionizing Industry and Commerce

The impact of UPI runs deep into the economy. Grocery and retail stores in July 2025 contributed 24% of all merchant UPI transactions by volume, and utilities and loan payments accounted for the highest transaction value. Maharashtra, Karnataka, and Telangana states alone processed over ₹1 lakh crore every month, indicating that UPI has become an imperative part of micro and macro business flows.

For micro, small, and medium enterprises (MSMEs), UPI has opened new doors. By creating verifiable transaction histories, it has improved credit eligibility and formalized trade. The RBI’s Financial Stability Report (June 2025) notes that UPI-linked small business accounts saw a 19% higher loan approval rate than cash-based ones.

This digital trail has also contributed to fiscal transparency, reduced tax evasion, and boosted government revenue from registered trade.

People Using UP | Photo Credit: Internet

Challenges and the Way Forward

The system is not without challenges, even if it has worked well. Zero-merchant-fee transactions put pressure on banks and payment apps that process large volumes without commensurate revenue. The RBI and NPCI are considering tiered fees that are affordable but sustainable.

Safety is another issue on hand. With UPI growing in Tier-III and rural areas, cyber fraud complaints have increased 11% year-on-year, the CERT-In 2025 report says. Programmes such as UPI Safety Week, multi-factor authentication, and campaigns to educate users are crucial to secure this huge ecosystem.

The Human Revolution Behind the Numbers

UPI’s journey is more than a story of data or transactions. It is a story of empowerment. It has turned the mobile phone into a microbank, and every QR code into a symbol of inclusion. The chai vendor, the rickshaw driver, the college student, and the homemaker all now participate in a digital economy once reserved for the elite.

UPI hasn’t just computerized India’s payments; it has democratized finance itself. The world is watching as India keeps demonstrating that technology, when crafted for simplicity and scale, can cross even the widest of chasms

Credits

- Reserve Bank of India (RBI) – Monthly Bulletin, March 2025 and Financial Stability Report, June 2025

- National Payments Corporation of India (NPCI) – UPI Annual Report 2024–25

- India Brand Equity Foundation (IBEF) – Digital Payments in India: Growth and Trends, June 2025

- Confederation of Indian Industry (CII)–Ernst & Young (EY) – Digital Payments Report 2025

- PayNearby Research Insights – Rural Digital Commerce Study, 2024–25

- Computer Emergency Response Team of India (CERT-In) – Cyber Fraud and Fintech Safety Report, 2025

- ACI Worldwide & GlobalData – Real-Time Payments Report 2025

- Ministry of Electronics and Information Technology (MeitY) – Digital India Progress Dashboard, 2025