For over a decade, affordable housing has been positioned as a cornerstone of India’s urban development program. Government schemes such as Pradhan Mantri Awas Yojana- Urban (PMAY-U), new financing norms and private-sector innovations were expected to unlock millions of homes for low- and middle-income families. Despite these policy initiatives, the affordable housing segment appears to be moving away from its promise. India is currently dealing with an uncomfortable paradox. Supply is fast declining while demand for reasonably priced homes is at an all-time high. This discrepancy calls for a basic question: is the affordable housing plot going off script?

Affordable Housing as a Pillar of Inclusive Growth

Affordable housing is not just a type of real estate. It is a social and economic stabiliser for the reasons stated ahead. First, it drives workers productivity in urban areas by letting workers reside closer to job areas and transit corridors. When people are compelled to travel large distances, cities face the penalty through reduced efficiency, higher congestion and deepening inequalities. Reducing commuting times, well-located and reasonably priced homes contribute to the development of an inclusive urban economy. Second, social mobility is made possible by affordable housing. For any family, home is the largest asset to own. Hence, providing a foundation of financial security is a must. It enhances access to education, healthcare and secure work. It further encourages long-term upward mobility. Thirdly, it encourages sustainable urban development. Transit-oriented development may support global climate and sustainable development goals (SDG11). It can be encouraged by well-planned affordable housing, also slowing the expansion of informal settlements and lessens environmental deterioration. Given these advantages, the present slowdown in the production of affordable housing represents a wider socio-economic issue rather than only a market problem.

Insights from the Latest Housing Data

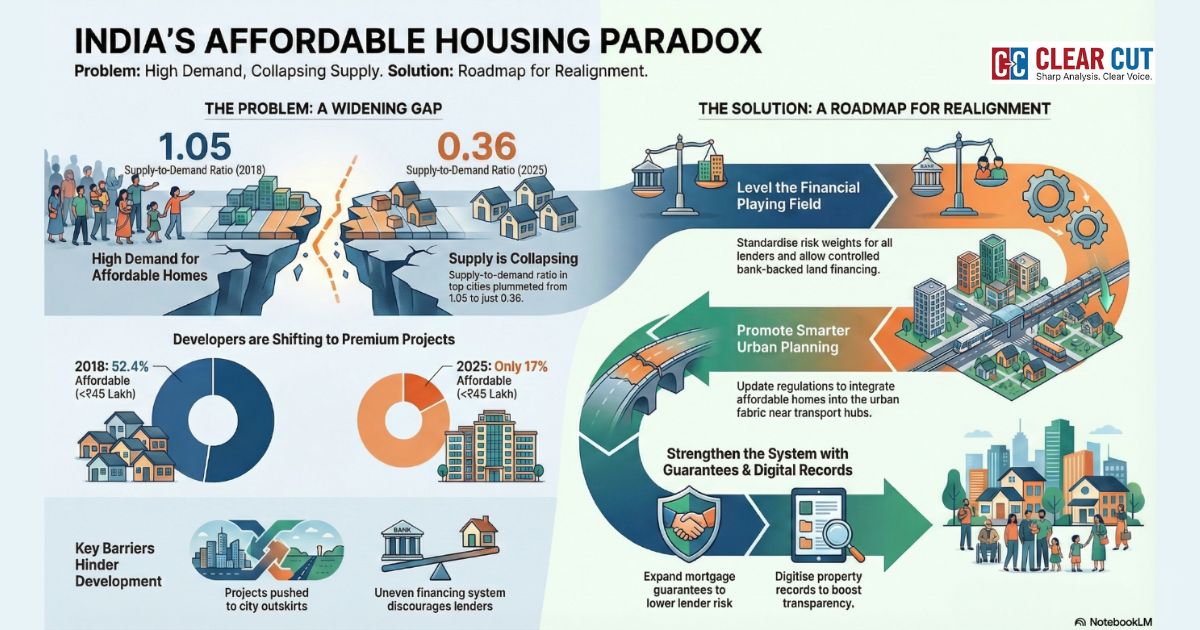

Despite confidence from lenders and politicians, the numbers point to a concerning trend. First, there is no longer any supply. Knight Frank’s 2025 data shows the supply-to-demand ratio in the top eight cities of India. It states the decreasing trend of 1.05 to 0.36 in 2019. Further, new launches are shrinking to just a third of sales evidence that few fresh affordable housing developments are entering the pipeline. Second, the market share of inexpensive units is steadily declining. Homes priced below ₹45 lakh in metros accounted for 52.4% of new launches in 2018, but only 17% in 2025. This was because of the reason that developers progressively migrate to mid- and premium-segment projects that provide larger profits. Third, geography is now a crucial obstacle. As Anuj Puri of Anarock points out, “Many so-called “affordable” developments are being pushed to the outskirts of cities, cut off from employment and transportation. Long commutes, increased transportation expenditures and a lower quality of life are hidden costs associated with these residences. Even though they may be less expensive initially, consequences can be seen later. Fourth, financing deficits are structural rather than just monetary. The lending ecosystem is still uneven despite the RBI’s revision of priority-sector lending thresholds. Banks prefer higher-ticket loans due to lower risk weights of 35%. While NBFCs and HFCs serve the majority of affordable borrowers facing 100% risk weights, high operating costs, and increased credit exposure. Even worse, National Housing Bank refinance and mortgage guarantee benefits are not available to NBFCs, which puts pressure on these small critical lenders to the margins. Finally, developers encounter major land acquisition barriers. Banks cannot fund property purchases and NBFCs operate under stringent regulatory constraints. This leaves the small developers unable to secure well-located land plots near transit or job hubs. As a result, developers have little motivation to significantly increase supply in this market. Despite the fact that demand is still high and affordability is declining.

Re-aligning the Affordable Housing Sector

India needs to reconsider its funding systems and urban development standards in order to bring affordable housing back. First, a level playing field would be created by standardising risk weighting among banks. NBFCs, and HFCs, may give loans for affordable housing. Equal risk weights would boost loan disbursement, lower borrowing costs and assist lenders at the base of the pyramid. Extending SARFAESI Act, 2002 and access to all regulated lenders would also improve recovery mechanisms and encourage increased participation. Second, it could be revolutionary to allow controlled bank-backed land financing for affordable housing. Allowing banks to support land acquisition under strict transparency norms, escrow mechanisms and project-linked safeguards would reduce delays. It may also help developers secure land parcels closer to city centres rather than on the distant peripheries. Third, increasing mortgage guarantee initiatives is needed. India can follow the lead set by the United States and Canada. Here the mortgage guarantees greatly lower lender risk and increases loan availability for first-time and credit-worthy homebuyers. Fourth, states must update their Development Control Regulations (DCRs) to promote affordable housing that is focused on transit. Adopting inclusionary zoning, requiring mixed-income complexes and giving priority to greater FSI around transit nodes will guarantee that inexpensive apartments are incorporated into the urban fabric rather than being pushed to the periphery. Lastly, it is critical that land and property records be digitized. In addition to increasing transparency and lowering transaction risk, clean and verifiable digital records reduce title disputes and facilitate lenders’ confident operations in underdeveloped areas. Together, these measures will reshape the affordable housing environment and make it both viable for developers and accessible for families who need it the most.

Conclusion: Affordable Housing Must Be Reimagined

India’s affordable housing sector is not suffering from a lack of demand rather from a failure of policy and planning alignment. Urban planning, financing standards, policies, and developer incentives are all moving in various directions. Unless these are channelised, the sector risks slipping farther off script. India can recover its affordable housing goal and guarantee that urban development stays inclusive and sustainable with a revitalised strategy prioritising location, financial equity, regulatory support and international best practices.

Clear Cut Livelihood Desk

New Delhi, UPDATED: Dec 03, 2025 03:15 IST

Written By: Nidhi Chandrikapure